Top 5 Contributors: Ken Gosney, Shelley Redinger, Darin Redinger, Barbara Stephens, Katrina Waters

Frequently Asked Questions

(FAQs)

How do schools receive the money they need to provide an education for all students? The answer is complex.

The root of the answer lies in state law. Washington is required to fully fund “basic education” based on a funding distribution formula referred to as the “prototypical model.” This model represents the Legislature’s assumptions about the costs associated with providing a “basic education” to student seedlings. Sadly, the money provided by the state for schools does not cover the actual cost of operating, constructing, and maintaining a school district. Local community funding measures, called levies and bonds, fill the gap between state funds and the real cost of providing the structures and services that help students grow and thrive.

Types of Levies on the February 2026 Ballot

Enrichment levies, also known as Educational Programs and Operations (EP&O) levy, funds important school services and positions like teachers, support staff, supplies and materials, or services that the state only partially funds or doesn’t fund at all. State money for schools provided via the prototypical funding model does not fully cover the actual costs of operating a school district, so enrichment or EP&O levies bridge the funding gap. Enrichment levies can be approved for up to four years.

Capital Projects Technology (Tech) levies fund things like 21st Century technology, curriculum, data center cooling, enhanced building security, and renovation projects. Capital levies can be approved for up to six years.

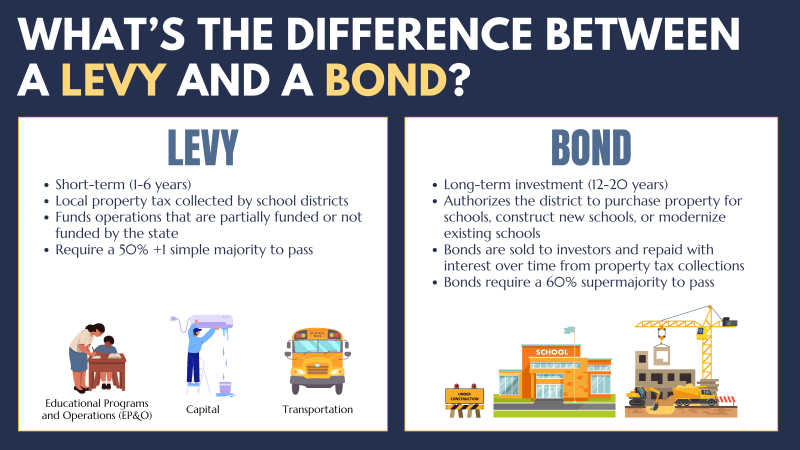

What is the difference between a Levy and a Bond?

Levies are for learning

A levy is a short-term, local property tax passed by the voters of a school district that generates revenue for the district to fund programs and services that the state does not fund or fully fund as part of “basic education.”

Levies require a simple majority to pass (50% + 1)

* The statement “levies are for learning” primarily refers to enrichment levies or EP&O levies.

Bonds are for building

A bond provides funding for capital projects such as purchasing property for schools, constructing new schools, or modernizing existing schools. Bonds are sold to investors who are repaid with interest over time from property tax collections, generally between 10-25 years.

Bonds require a super majority to pass (60%)

What is a levy rate?

A levy rate is the amount of property tax collected per $1,000 of assessed property value. The money collected is used to fund a voter-approved total levy collection amount over a series of years.

Example: If a homeowner has a home valued at $200,000 and the levy rate is $1.00 for every $1,000 of assessed property value, the homeowner will pay $200 annually in property taxes.

What do these levies pay for?

The Technology Levy will make 21st Century technology available in the learning environment. This will include

Enhanced IT support

Improved Technology

Infrastructure

Staff Training

Professional Development

Replace/Add Devices

The Educational Programs and Operations (EP&O) funds important school services and positions like teachers, nurses, school psychologists, counselors, and other support staff. It will also purchase supplies and materials, and enrichment activities not covered by the funds the state provides to the district.

How much will this levy cost me?

The Technology Levy will be $0.50 per $1,000 in assessed property value.

The EP&O Levy will be $2.50 per $1,000 in assessed property value.

Combined, the levies will cost $3.00 per $1,000 in assessed property value.

Please use this page to determine the cost to you.

Doesn’t the state provide all the funding schools need to operate?

Another example is safety and security staff. For every 430 students, the prototypical model funds one safety and security staff member.

I support schools but I already pay a lot in tax. Will I pay more?

The current levies were approved by voters in 2022 with a term of four years (expiring in 2026). These new levies maintain the same taxation rate and would replace those that are expiring. You may use this calculator to determine what you would expect to pay.

Is there a tax break for senior citizens?

Didn't we vote on this last year?

No! The issue before the voters last year was a Bond to build a third high school.

If the levy funds extracurricular activities, why is there such a huge discrepancy in fees to participate in different activities? Marching Band is $500 and Football is $50?

The levy does provide funding for extracurricular activities, although not all the costs for each activity can be collected in this manner. The levy pays for staff such as coaches and directors.

In the football example, of the $50 football fee, $40 goes to the district to pay for busses and drivers to travel to the various events. The remaining $15 stays at the school to help with uniform support, etc. Sports programs are also supported through event entry fees. Any additional money the football team may need to feed players at away games, buy new equipment, and pay for uniforms comes from fundraising by the team. This is often seen as offering camps for younger players or the sale of merchant discount cards. Most other sports look similar to this, although the fundraising methods may vary.

Band fees are set by the band director/teacher and reflect the cost of transportation, contests, food, lodging, and equipment. In many cases there are fundraising opportunities for the students to help offset their fees. These fundraisers vary from school to school but are often sales of items such as soda, Butterbraid or apples.

Is the district planning to use this levy to bring the fund balance into "healthy" status.

No. The collected levy dollars will have a direct impact to students, by funding staff, coaches, and supplies. If the levy doesn’t pass, the district cannot afford offer many of the supplemental activities that the community has come to expect. Drastic changes would be needed to keep basic education funded.

What is LEA and how did it contribute to the budget shortfall?

Levy Equalization, or Local Effort Assistance (LEA) is one category of school funding from the state. These funds ensure that school districts in areas with lower property values can provide essential programs and services to the students in those areas. LEA funds are only available to districts that have levies in place.

The Tri-Cities has historically had a lower cost of living compared to other areas in Washington State. As such, the school districts included LEA when formulating their budgets.

In recent years, property values in the area have risen significantly. This reduced the amount of LEA funds the Richland School District was eligible to receive from the state. And it significantly reduced the budget income, necessitating spending cuts.

Future LEA dollars will help the district rebuild its fund balance, but only if the levy passes.

Is it possible for one levy to pass and the other to fail?

Yes. It is possible for the voters to approve one levy but not the other. Passing one but not both levies will still have a significant impact on the district budget.

We are asking voters to vote YES to both the EP&O levy and the Capital Project Technology levy.

Where can I learn more?

For more information about the Richland School District Levy please visit https://www.rsd.edu/district/bonds-levies/2026-levy