Top 5 Contributors: Ken Gosney, Shelley Redinger, Darin Redinger, Barbara Stephens, Katrina Waters

Calculate My Tax

For the most accurate results, please refer to your most recent property assessment issued by the Benton County Assessor.

To find your assessed value, click here to use the Benton County Assessor’s property search.

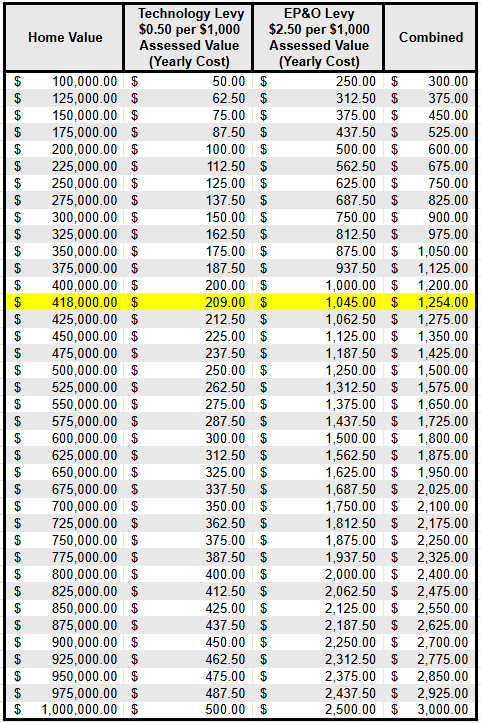

The Capital Projects Technology Levy will be $0.50 per $1,000 in assessed property value.

The EP&O Levy will be $2.50 per $1,000 in assessed property value.

Combined, the levies will cost $3.00 per $1,000 in assessed property value.

Per Benton County, the average house price in Richland is $418,142. If both levies are approved the tax on a $418,142 house is $1,254 per year. This is the same rate that taxpayers are currently paying.

This levy is not a new tax, it’s a renewal of an existing tax.

Capital Projects Technology Levy

The Capital Projects Technology Levy will make 21st Century technology available in the learning environment. This will include

- Enhanced IT support

- Improved Technology

- Infrastructure

- Staff Training

- Professional Development

- Replace/Add Devices

The Capital Projects Technology Levy will be $0.50 per $1,000 in assessed property value.

EP&O Levy

The Education Programs and Operations Levy will provide funding for important school services and positions like teachers, nurses, school psychologists, counselors, and other support staff. It will also purchase supplies and materials, and enrichment activities not covered by the funds the state provides to the district.

The EP&O Levy will be $2.50 per $1,000 in assessed property value.

Exemptions

Senior citizens and individuals with disabilities may qualify for an exemption. For more information on qualifications, please contact the Benton County Assessor’s office.